how are property taxes calculated in broward county florida

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. The information provided above regarding approximate insurance approximate taxes and the approximate total monthly payment collectively referred to as approximate loan cost illustration are only.

Broward County Fl Property Tax Search And Records Propertyshark

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

. The amount of property taxes you owe in Broward County is determined by two things. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. See Property Records Tax Titles Owner Info More.

You sell your current Florida Homestead that has an Assessed Value of 200000 and a Just Market Value of 350000. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The Broward County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood.

Intangible Tax on Promissory Notes Written Obligations to pay money mortgages etc. This tax estimator is based on the average millage rate of all Broward municipalities. Our Broward County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States.

Ad Property Taxes Info. Typically Broward County Florida property taxes are decided as a percentage of the propertys value. Property taxes in Florida are implemented in millage rates.

The assessed value of the property and the tax rate. The assessors office can provide you with a copy of your propertys most recent appraisal on request. Broward County Careers MENU Search.

How Are Property Taxes Calculated in South Florida. NEW HOMEBUYERS TAX ESTIMATOR. Online Property Taxes Information At Your Fingertips.

Documentary Stamp Tax on Promissory Notes Written Obligations to pay money mortgages etc rounded up to the nearest 10035 per 100. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. You can see the differences when you claim this property as your primary residence and receive the Homestead Exemption or other exemptions based on various issues.

How Broward County property taxes are determined The value of your property is determined by your local property appraiser and is based on the propertys fair market value. Tax rates differentiate widely but they normally run from less than 1 up to about 5. The Broward County Property Appraisers Office assesses the value of your property and applies eligible tax exemptions that can lower the taxable value of your property.

Search Any Address 2. Taxing Authority Phone Listing. Choose RK Mortgage Group for your new mortgage.

Assessed Value minus exemptions Millage Rate 1000 Your Property Tax Assessed Value The assessed value is the value of your property as determined by a Property Appraiser. Tangible Personal Property Tax. Under Florida law e-mail addresses are public records.

Exemptions Exemptions allow you to save up to thousands of dollars in property taxes. Broward County Property Appraisers Office - Contact our office at 9543576830. Broward County Florida Mortgage Calculator.

Having trouble viewing our website. Search all services we offer. Present this offer when you apply for a mortgage.

How are property tax bills calculated in Broward County FL. Current tax represents the amount the present owner pays including exemptions. The median property tax also known as real estate tax in Broward County is 266400 per year based on a median home value of 24750000 and a median effective property tax rate of 108 of property value.

Florida Agencies Florida Counties Lobbyist List. Base tax is calculated by multiplying the propertys assessed value by the millage rate applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. If you would like to calculate the estimated taxes on a specific property use the tax.

Each property is individually t each year and any improvements or additions made to your property may increase its appraised value. If you do not want your e-mail address. How Property Tax is Calculated in Broward County Florida.

Documentary Stamp Tax on Deeds and other Instruments related to real property rounded up to the nearest 10070 per 1 00. 350000 200000 150000 in Tax Benefit. The rates are expressed as millages ie the actual rates multiplied by 1000.

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. In order to levy this tax the tax authorities in Broward County Florida must have an uniform formula for figuring out the value of a. A number of different authorities including counties municipalities school.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. Property Taxes Currently selected. Calculation for Deed Doc Stamps or Home Sale Price.

Broward County calculates the property tax due based on the fair market value of the home or property in question as determined by the Broward County Property Tax Assessor. If you think your propertys value has been calculated incorrectly you can appeal the assessment with the Broward County Property Appraiser.

Property Tax By County Property Tax Calculator Rethority

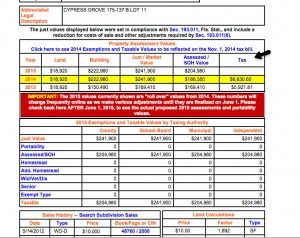

Explaining The Tax Bill For Copb

Broward County Property Taxes What You May Not Know

Broward County Fl Property Tax Search And Records Propertyshark

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator

Your Guide To Prorated Taxes In A Real Estate Transaction

Florida Property Tax H R Block

Calculating Your Miami Dade Or Broward County Property Taxes

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Property Tax Appeal Tax Consulting Consulting Firms Property Tax

Broward County Fl Property Tax Search And Records Propertyshark

Broward County Fl Property Tax Search And Records Propertyshark

How Tax Friendly Is Fla Compared To Other States Florida Realtors En 2022

Explaining The Tax Bill For Copb

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Broward County Fl Property Tax Search And Records Propertyshark